Understanding auto body cosmetic repair coverage requires reviewing insurance policies, as standard plans usually exclude non-structural damage like minor scratches and dents. Comprehensive endorsements may be available for certain repairs, but services like paint jobs often require out-of-pocket expenses unless explicitly included. Distinguishing between cosmetic and structural damage is key; while the former addresses visual issues without affecting safety, the latter involves critical components essential for driving safely. Insurance policies vary in their coverage, with basic plans typically covering structural damage but excluding cosmetic repairs, requiring specific endorsements or tailored services. Navigating claims requires understanding insurer policies, preferred repair shops, and deductible limits, emphasizing the importance of reviewing policy documentation and contacting insurance providers directly for clarification.

Are you wondering if fixing that dent or scratch on your car is covered by insurance? This guide explores the often-confusing world of auto body cosmetic repairs and insurance coverage. We break down the distinction between cosmetic and structural damage, navigate the claims process, and examine common insurer policies. Understanding these factors empowers you to make informed decisions, ensuring peace of mind for your vehicle’s aesthetic and financial well-being.

- Understanding Insurance Coverage for Auto Body Cosmetic Repairs

- What Constitutes Cosmetic vs. Structural Damage

- Navigating Claims Process and Common Insurer Policies

Understanding Insurance Coverage for Auto Body Cosmetic Repairs

When it comes to auto body cosmetic repairs, understanding your insurance coverage is essential. Many people wonder if their car’s curb appeal can be restored while staying within their budget, and the answer often lies in their insurance policy. Typically, standard auto insurance policies do not cover non-structural or cosmetic damage. This means that minor scratches, dents, or even a fender bend might not be reimbursed by your insurer. However, some policies may offer optional endorsements for comprehensive coverage, which can include certain cosmetic repairs.

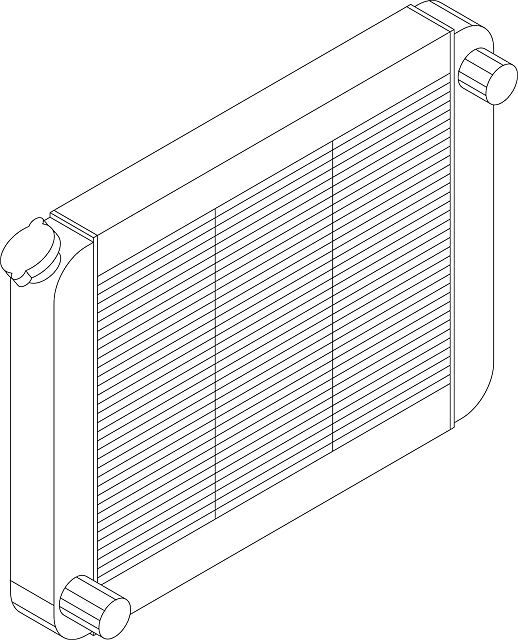

Insurers differentiate between structural and cosmetic repairs because the former involves safety-critical components, while the latter typically enhances the vehicle’s appearance. For instance, a vehicle body shop repairing a cracked windshield or replacing a damaged fender would likely be covered under structural repair terms. On the other hand, services like paint jobs, wheel refinishing, or window tinting fall under cosmetic repairs and may require out-of-pocket expenses unless specifically included in your insurance plan.

What Constitutes Cosmetic vs. Structural Damage

When it comes to auto body cosmetic repairs, understanding the distinction between cosmetic and structural damage is essential. Cosmetic damage refers to the visual aspects of a vehicle that impact its appearance but do not affect its safety or structural integrity. This includes issues like dents, scratches, cracked windshields, and minor paint chips or bumps. On the other hand, structural damage involves the frame, chassis, and critical components of a car, ensuring it remains safe and roadworthy. For example, misaligned frames caused by accidents or severe impacts require professional frame straightening services, which fall under structural repair.

Many insurance policies differentiate between these two types of repairs, offering varying levels of coverage. Typically, basic auto insurance plans cover structural damage repairs, seeing them as essential for road safety. However, cosmetic repairs like paint jobs and minor body work might be considered optional or left out of standard coverage. This is where understanding your policy becomes crucial. Some policies may include comprehensive coverage that can offset the costs of auto body cosmetic repair, while others may require additional endorsements or specific collision repair shop services tailored to tire services and frame straightening.

Navigating Claims Process and Common Insurer Policies

Navigating the claims process for auto body cosmetic repairs can seem daunting, but understanding your insurer’s policies is key. Many insurance plans do cover these types of repairs, often under specific circumstances. For example, if a claim is filed due to a collision or accident, the cost of repairing the vehicle’s exterior may be covered, including services like painting, detailing, and even auto dent repair. However, pre-existing damage or cosmetic issues not related to an incident might not be insured. It’s essential to review your policy documentation carefully to understand what is considered a covered claim.

When it comes to common insurer policies, many companies have different criteria for evaluating auto body cosmetic repair claims. Some insurers may require you to use specific collision repair shops or approve the chosen repair methods before proceeding. They might also set limits on the amount they’ll cover for such repairs. For instance, deductibles play a significant role, as policyholders are typically responsible for this out-of-pocket expense initially. It’s advisable to contact your insurance provider directly to discuss your specific situation and gain clarity on what is covered under your plan.

When it comes to auto body cosmetic repairs, understanding your insurance coverage is key. While many policies do not cover cosmetic damages as they are considered minimal or aesthetic improvements, there are exceptions and nuances to explore. By recognizing the distinction between cosmetic and structural damage, and familiarizing yourself with insurer policies, you can effectively navigate the claims process. Remember, thorough documentation and clear communication with your insurance provider are essential steps in ensuring a successful claim for auto body cosmetic repair.